Standard Business Reporting is the national standard for the digital exchange of business reports. SBR enables Dutch businesses and their intermediaries to reduce reporting and administration work in the exchange of business information to local authorities and banks.

SBR enables information in company records to be captured once only in a standard way. This means that the information can easily be reused for various reports to government agencies and a number of banks.

SBR applies international open standards, including XBRL and web services in a way that enables a high degree of automation within the business reporting processes; from data gathering and transfer to validation and processing. It makes the reporting chain more efficient and effective and delivers substantial benefits to all participants in the reporting chain.

Various reports

Jointly with market organisations, such as audit firms, bookkeepers, software vendors and banks, the Dutch government is the owner of SBR. Currently, SBR accommodates the exchange and processing of tax returns, statistics reports and financial reports on a large scale in the Netherlands. Given its widely acknowledged success, SBR has matured to a ‘best practice’ that can be adopted in many reporting chains around the world.

In 2015, more than 22 million SBR messages will be exchanged.Companies can send or receive the following (compulsory) reports in SBR:

Tax and Customs Administration

- Sales Tax Reports

- Corporate Tax Return reports

- Surcharges

- Income Tax reports

- Assessment Service Notifications

- Pre-entered information Income tax reports

- Service notifications Benefits

Chamber of Commerce

- Annual accounts

Banks

- Credit reports

How it works

SBR prescribes the use of standards for data definitions, processes and technology. Software vendors can easily adapt their software for the SBR standards in order to read in regulators’ data definitions and submit reports to the applicable portal system, such as the Digipoort for regulators or the central portal run by the banks.

XBRL is one of the key standards of SBR. With XBRL, all reporting definitions are uniquely identifiable and stored in a so-called taxonomy. With this standard, organisations can easily report to multiple regulators.

Benefits

The main result of SBR is the large-scale reversal of the business reporting chain. SBR leads to an integrated way of thinking in terms of the structure of reporting chains. This increases the power of reporting parties vis-à-vis the requesting parties in the reporting chain, while requesting parties have more resources to enforce transparency.

The benefits of SBR for all reporting chains relate to further automation of business reporting and utilisation of shared services. SBR eliminates paper as a format for tax returns and financial statements, enabling organisations to reap the benefits of the use of structured digital data. SBR enables information in company records to be captured once only in a standard way. This means that the information can easily be reused for various reports to government agencies and a number of banks.

The main benefits of SBR are:

- Increased efficiency

- Standardisation

- Increased transparency

- Increased security

- Higher quality of data exchange

The future: broadening and deepening SBR

SBR is changing the reporting landscape. SBR goes beyond streamlining the individual business administration: SBR is the standard for the digital exchange of business reports, benefiting society as a whole.

Over time, SBR will be used in more reporting chains, for more reports, by more and more organisations.

In future years, SBR will expand in breadth and depth and we are working towards:

- Growth in the number of uses. Current requesting parties are making far wider use of SBR.

- Growth in the number of sectors. New sectors work with SBR, such as Education and Healthcare.

- International awareness of the benefits of the SBR concept.

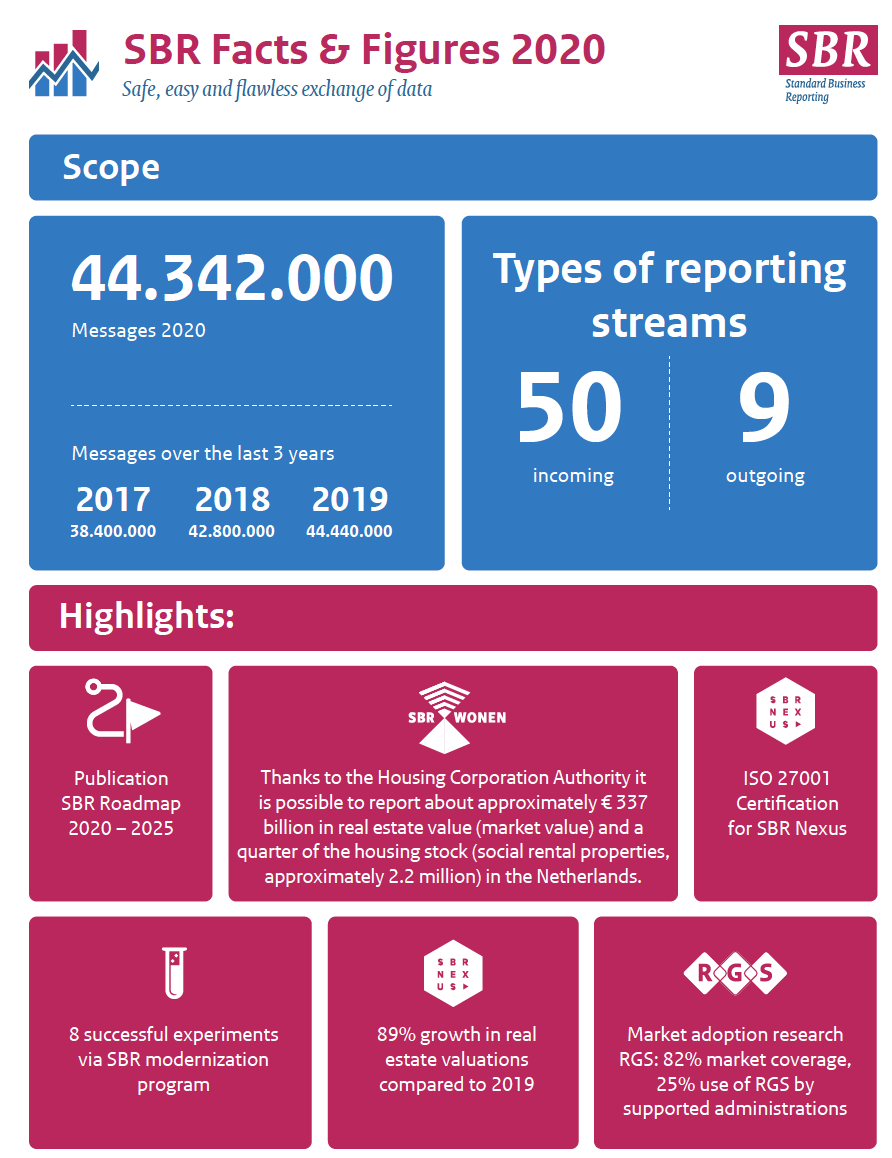

Facts and figures SBR in 2020

- 44.342.000 Messages

- 50 types of incoming streams

- 9 types of outgoing streams

Highlights 2020

- Publication SBR Roadmap 2020 – 2025

- Thanks to the Housing Corporation Authority it is possible to report about approximately € 337 billion in real estate value (market value) and a quarter of the housing stock (social rental properties, approximately 2.2 million) in the Netherlands.

- ISO 27001 Certification for SBR Nexus

- 8 successful experiments via SBR modernization program

- 89% growth in real estate valuations compared to 2019

- Market adoption research RGS: 82% market coverage, 25% use of RGS by supported administrations

Click the image to download the full infographic as pdf.

Read more

- Get the SBR book ‘Challenging the Chain’

- Qs for Frans Hietbrink, Strategic Advisor at the Netherlands Tax and Customs Administration